We all know bitcoin, right? The first commercial cryptocurrency started the global adoption of blockchain technology, peer-to-peer transactions, and pretty much everything in between. However, history is not the most interesting aspect of bitcoin. We are interested in Bitcoin Dominance - a concept that is not just language but comes as a tradable indicator - led by the Bitcoin Dominance chart.

Here is some perspective! Bitcoin was the first-ever cryptocurrency. Launched in 2009, it has appropriately held 100% of the cryptocurrency market share. Over time, other players began to appear. Ethereum, Litecoin, and the rest of the altcoins! Thus, Bitcoin's dominance began to decline as it continues to serve as an important metric for tracking total market capitalization, changing user opinions, and the state of the cryptocurrency market in general.

What does bitcoin dominance mean?

The short answer is (market cap of bitcoin over total market cap of cryptocurrencies) times 100

The detailed answer is that Bitcoin dominance is a percentage value that measures how dominant Bitcoin compares to the total market. The growth of the altcoin field (new coins/tokens appearing every day) has made Bitcoin's dominance a very useful tool. Many cryptocurrency traders and investors prefer to use this resource to fine-tune their portfolios and trading/investment strategies.

The growing dominance of Bitcoin means that Bitcoin is growing compared to other digital currencies. This development may mean the following:

- Bitcoin is eroding less than other corrective altcoins, especially in a bear market.

- More bitcoins are being added to its supply pool due to increased mining activity.

- A decrease in the total market value in a bear market.

- Total market cap is rising in a bull market, with bitcoin showing some aggressive price action compared to altcoins.

Why only Bitcoin and not Ethereum?

Since bitcoin dominance is a ratio of the bitcoin market cap to the total market cap, the method of calculation applies even to other cryptocurrencies. In theory, anyone can figure out the dominance of Ethereum or Cardano by applying simple math. However, we usually only talk about Bitcoin as it started as the first commercial cryptocurrency and is still the most popular to date - making up 39% of the entire cryptocurrency - in terms of market cap.

It's the first, and it's big. Hence the interest!

Moreover, bitcoin dominance is not a standalone concept. If you follow the Bitcoin Fear and Greed Index, you will know that “dominance” is one of the indicators of the sub-index with a weight of 15%.

Factors affecting Bitcoin dominance

Now that we have discussed a bit about Bitcoin dominance, here are some important factors that are known to influence the same:

Bitcoin value

If Bitcoin moves up on the price chart, its market dominance increases. Yes, the relationship is straightforward like that. When altcoins weren't so popular, Bitcoin's dominance was close to 90%. However, things are starting to change with blockchain-based games, financial services, and art growing in popularity by the day. Therefore, each new advance in the cryptocurrency space generates a new token that plays a role in driving down Bitcoin's dominance.

The only way to maintain Bitcoin's dominance is for the cryptocurrency's popularity to continue to rise. Value (price) may be subjective and may not truly represent Bitcoin's dominance at all times. We'll get to that later.

Alternative currencies

As mentioned earlier, the introduction of new currencies to the crypto space may lead to the dominance of Bitcoin. However, you may ask: “How can some of the newer, lesser-known currencies affect the market capitalization as large as Bitcoin?”

Well, the answer is simple: risk appetite. As of July 2022, more than 20,000 crypto assets have already been traded. People tend to try other options based on social sentiment, shillings, fundamentals, and hype. Remember that according to the bigger picture, Bitcoin is always ahead of every other asset. Thus, Bitcoin's dominance may suffer if funds start flowing into other cryptocurrencies in large numbers.

The popularity of stablecoins

Satoshi Nakamoto envisioned bitcoin for peer-to-peer transactions. Recently, stablecoins seem to have taken on this responsibility, leading to a surge of cryptocurrency investors on the exchanges. Therefore, the rise in popularity of stablecoins may significantly weaken Bitcoin's dominance. And unlike the newer altcoins, stablecoins such as USDT, USDC, BUSD, and others have a prominent presence in the market — making them worthy opponents for Bitcoin's dominance.

Market conditions

The nature of the market can also affect Bitcoin's dominance. You may see Bitcoin's dominance grow in a bear market, even as the overall market cap and Bitcoin decline. This is because, over time, Bitcoin has evolved into a relatively stable crypto asset, often lagging behind traditional markets such as the S&P 500. Bitcoin's stability means that a decline in the total market cap affects volatile altcoins more - leading to the growing dominance of Bitcoin.

In a bull market, the opposite may be true. Bitcoin's dominance may decline despite the growth in market capitalization because people are more willing to put money into riskier cryptocurrencies.

What is Bitcoin Dominance Chart/Indicator?

Bitcoin Dominance Chart is a visual representation of Bitcoin dominance as a concept. The chart identifies the dominance of Bitcoin as an indicator. Furthermore, the metric is provided by CoinMarketCap / CoinGecko and is on the homepage.

Date

Many trading communities started using the bitcoin dominance chart in 2017. However, the chart is starting to gain traction in 2021 - the era of the altcoin boom. Currently, it is one of the most reliable indicators of investment - more fundamental than technical - with Bitcoin slowly entering the stable crypto category.

Bitcoin Dominance Chart: Uses

The Bitcoin Dominance Chart is not your usual trading indicator. However, it has the following uses, which require further elaboration.

Risk aversion

The rising graph of Bitcoin's dominance shows that existing cryptocurrency traders and investors are slowly avoiding risk. This usually happens in a slow bear market when bitcoin looks like a reliable investment and trading option.

Market overview

The increasing stability of Bitcoin is the reason why it is inversely related to the total market capitalization.

Bitcoin dominance between April 2019 and June 2021

Total value between April 2019 and June 2021

Tradeability

Bitcoin dominance is not just an indicator. Alternatively, on Binance, you can trade BTCDOM/USDT perpetual futures contracts. Therefore, it is also possible to use Bitcoin Dominance as a short-term, leveraged trading tool, provided you know how to read the Bitcoin Dominance chart in relation to other metrics.

Benefits of the Bitcoin Dominance Scheme

If you can read the bitcoin dominance chart, you can expect to reap the following benefits:

- You may be able to identify the beginning of the bear market and bull market phases.

- You can define reflection patterns.

- It may be possible to define new altcoin seasons, the phases in which cryptocurrencies thrive in terms of valuation.

- In a downward phase, Bitcoin's increasing dominance can predict a short-term, market-wide price consolidation phase.

Disadvantages of using a bitcoin dominance chart

Despite the advantages, the dominance scheme is not perfect. Here are some drawbacks to come to terms with:

Oversupply

An increase in the supply of Bitcoin due to mining activity may lead to an isolated increase in the Bitcoin dominance chart. However, this type of chart development is not particularly useful when it comes to analyzing trading movements.

Deficiencies in the market value

Market capitalization as a valuation indicator is not always accurate. There can be seasons when some altcoins pack a lot of market size due to increased trading volume and activity. Even sympathetic drivers can drive up the price of the tokens, which increases the market cap. If gains across other cryptocurrencies are significant, bitcoin could end up dominating.

Real bitcoin dominance indicator

The Dominant Chart/Indicator risk can be overridden to a certain extent by the real Bitcoin Dominance Indicator. This indicator works similarly but only compares the market capitalization of Bitcoin against PoW cryptocurrencies. According to this indicator, comparing Bitcoin to every other altcoin out there is like comparing apples to oranges.

This indicator is useful for PoW holders, who have not been involved in ICO based offerings for a long time.

How to trade cryptocurrency with bitcoin dominance

Bitcoin dominance chart can act as an effective indicator. Here's how it works:

Bitcoin dominance to analyze market trends

Like any other scheme, even the bitcoin dominance scheme moves in cycles. Hence, the concept of identifying a series of lower highs to identify downtrends can be useful in understanding the breadth of the market.

The bearish control graph shows the dilution. In a bull market, this may indicate a boom in the popularity of altcoins. In a bear market, this may indicate a trend reversal because it shows that people are becoming confident enough to invest in other altcoins.

Use of bitcoin dominance in relation to the price of bitcoin

Traders often analyze Bitcoin price and dominance simultaneously to arrive at trading results. When both dominance and prices are rising, a bull market may be imminent.

Falling prices and increasing dominance may be bearish market signals. Finally, if both indicators decline, there could be a larger downtrend followed by sideways movements around the corner.

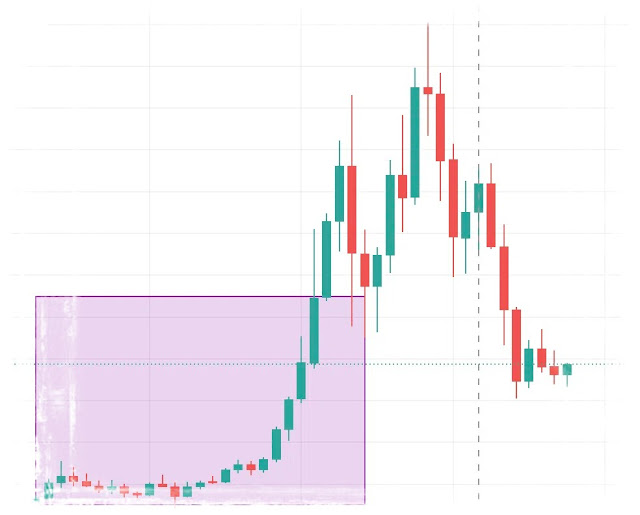

The first chart shows the peak of Bitcoin’s price movement between January 2021 and May 2021. In response, the Bitcoin Dominance chart traded flat and even lowered at the end of the mentioned period. If you look closely, you will see that after the highlighted area, both the dominance and the price started to decline, which led to a new bitcoin price drop. The market engulfed a larger downtrend until July 2021.

Finally, rising prices and declining dominance serve as other indicators. It shows that Bitcoin prices are increasing despite the declining index, which means that the movement in the altcoin counters is more aggressive.

Here is what happened after July 2021:

Bitcoin prices started to rise between July 2021 and November 2021

Bitcoin's dominance has not decreased, but has increased slightly over that period

Enough use cases? Here are some tables with some combinations to help you make the right choices:

Case 1: Bitcoin's dominance is increasing

- Bitcoin Price Action (Potential) in favor of bitcoin

- It will pass pressure on banknotes (down waves)

- Sideways Hold Bitcoin / Banknotes (Scattered Markets)

Case 2: Bitcoin's dominance is declining

- Bitcoin price action (potentially) up in favor of altcoins

- Keep Squeezing the Banknotes (Massive Downward Waves)

- Sideways in favor of altcoins (altcoin season building)

Case 3: Bitcoin dominance is sideways

- Bitcoin Price Action (Potential) Works for bitcoin (external money coming into bitcoin)

- Keep pressing banknotes (downward waves)

- Hold on to altcoins/cash

Is Bitcoin Dominance Chart a Reliable Indicator?

The Bitcoin dominance chart is reliable if you have the bigger picture in mind. However, it misses the mark in the following areas:

- It does not take into account direct competitors, but focuses on the entire market.

- It could be affected by the increasing popularity of stablecoins, which is somewhat counterproductive given that stablecoins are not as volatile as other currencies.

- It does not take into account the missing coins of the bitcoins that the market value of bitcoins is still showing its value (that is, the coins that were in wallets that cannot be accessed).

- Every altcoin project is considered, even if it initially attracts a lot of investment and later turns out to be a scam.

Bitcoin dominance is a useful tool for trend analysis

This sums up the Bitcoin dominance discussion. Needless to say, the cryptocurrency plays a central role in the cryptocurrency market with its dominance of almost 65%. The Bitcoin Dominance Chart is a useful tool, though not the only one you should use.

With loads of altcoins and stablecoins popping up every day, the bitcoin dominance chart may soon re-read. At the moment, it is holding on to 39.9% levels and is a trend analyzer and under price forecaster. However, if you can read both dominance and price, gaining actionable insights becomes easier.